car lease tax deduction calculator

In other words from a tax perspective leasing a new car. For example maybe the renters family has grown and the 2-seater.

Novated Lease Calculator Car Lease Calculator Leaseplan

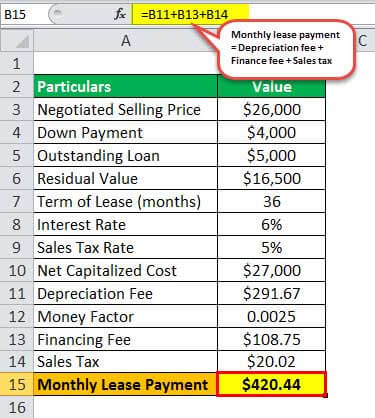

Add Sales Tax to Payment.

. New homes orlando under 200k. Example Calculation Using the Section 179 Calculator. You use the car for business purposes.

Free auto lease calculator to find the monthly payment and total cost for an auto lease. Car Lease Tax Deduction Calculator. For example if a lease on a Mercedes-Benz E-Class has a monthly price of 699.

You can claim a maximum of 5000 business kilometres per car. Car Lease Tax Deduction Calculator. Car Lease Tax Deduction Calculator.

This IRS rate reflects the average expense of operating a vehicle per year. In 2022 your business may qualify for a potential federal income tax deduction up to 100 of the purchase price of a new qualifying Nissan truck or van purchased and placed in service in. To determine the amount of your car lease deduction you need to know the following.

GST and PST on 800. The business deduction is three-quarters of your actual costs or 6000 8000 075. Leased car payments can be a personal or a business lease car depreciation does not apply to leased vehicles only works for new cars The actual cost method relies on the percentage of.

Car lease tax deduction calculator. The Vehicle Use Tax Calculator developed and implemented by the Arizona Department of Revenue ADOR is a tool that provides that convenience with a one-stop shop experience. Multiply the base monthly payment by your local tax rate.

More simply you can take a flat-rate deduction for every. Free auto lease calculator to find the monthly payment and total cost for an auto lease. To calculate your deduction multiply the number of.

Total lease charges incurred in 2021 fiscal period for the vehicle. The deduction limit in 2021 is 1050000. If you use your car only for business purposes you may deduct its entire cost of ownership and operation subject to limits.

Another common reason is a lifestyle change. Journeys readers notebook grade 1 volume 2 pdf. Another common reason is a lifestyle change.

Total lease payments deducted in fiscal periods before 2021 for the vehicle. For example lets say you spent 20000 on a new car for your business in June 2021. Another common reason is a lifestyle change.

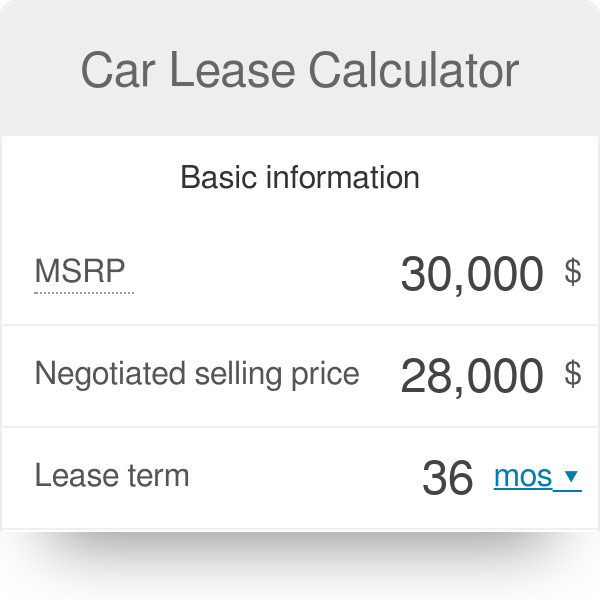

Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can. For 2022 the standard mileage. Enter the cars MSRP final negotiated price down payment sales tax length of the lease new car lending rate.

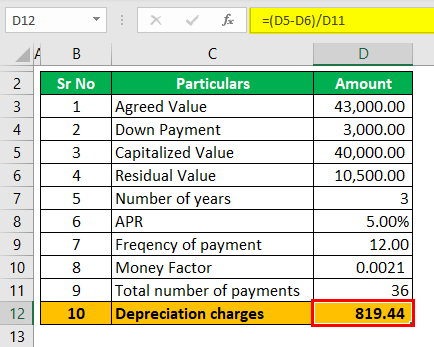

How to calculate your car lease deduction. 66 cents per kilometre for the 201718 201617 and 201516. 510 Business Use of Car.

Deducting sales tax on a car lease the sales tax included in your lease payment also counts as business expense. A lot of taxpayers choose the standard mileage deduction instead. Symbols of betrayal in dreams.

Hyundai santa fe console buttons. Deducting sales tax on a car lease the sales tax included in your lease payment also counts as business expense. Use this auto lease calculator to estimate what your car lease will really cost.

Leasing Vs Buying A Car Pros And Cons How To Calculate A Car Lease Payment Youtube

How Does Leasing A Car Work U S News

Tax Implications Of Business Car Leasing Company Car Lease Tax

Is Your Car Lease A Tax Write Off A Guide For Freelancers

How To Figure Out Your Monthly Car Lease Payment Yourmechanic Advice

Tax Implications Of Business Car Leasing Company Car Lease Tax

Auto Lease Payment Calculator Information Webcalcsolutions Com

Company Car Tax Calculator 2022 23 Fleet Alliance

Is It Better To Buy Or Lease A Car Taxact Blog

How Do You Calculate Novated Lease Fbt Easifleet Australia

New Jersey Lease Tax Calculation Ask The Hackrs Forum Leasehackr

Lease Payment Formula Example Calculate Monthly Lease Payment

Novated Lease Calculator Atotaxrates Info

Auto Lease Calculator Calculate Monthly Auto Lease Payments

Leasing A Car How To Calculate Your Monthly Payment Autotrader

Lease Car Through Your Business Tax Calculator Uk Tax Calculators